On Monday, a very interesting post came to my attention: Frances Coppola commented that the possibility of Quantitative Easing (QE - the process by which the Central Bank buys back government bonds and gives "cash" back to the banks so that they could increase lending) being deflationary instead of inflationary, as theory expects it to be, is large; and the data seem to agree with her (for her excellent points have a look here). This discussion, spurred spin-off blog where an abundance of sources on the issue can be found. As in any discussion, supporters of both views exist. An example would be Pawel Morski, who provides a very interesting graph and comments that QE is nothing but the only option, and this is better than doing nothing at all.

Although QE may be better than sitting idly around, the question of it being either inflationary or deflationary still exists. Thus, the question now becomes how QE can affect the level of prices. As the quantity theory of money states, MV=PQ. Given that we want to observe the effects QE has on the price level, we want to check how it affects money, velocity and output (M,V and Q respectively). The theoretically obvious effect of QE is on the money supply. If banks have more cash, then they would be inclined to lend more money, thus increasing money supply.

The above would hold if and only if the banks decide to increase their lending. If the banks are constrained by their regulatory needs or choose not to give out loans for any other reason, having more cash will not assist them in increasing spending (for further details on how this works I refer the reader to a previous post). During the QE phase, banks essentially swapped a 0% risk-weighted asset (bonds) with another 0% risk-weighted asset (cash), thus their risk-weighted assets (RWA) have not changed; yet, RWA will be increased if banks lend out any money (all personal/mortgage/corporate loans have a risk weight of at least 20%).

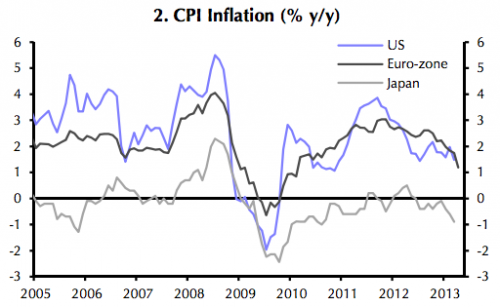

Nevertheless, the money supply indices (both credit and monetary base) show an increasing trend even after QE, while inflation appears to decrease:

Nevertheless, the money supply indices (both credit and monetary base) show an increasing trend even after QE, while inflation appears to decrease:

|

| Source: FT Alphaville |

A careful look at the data provided by the Federal Reserve shows that the increase in money supply is losing speed: In the first 4 months of 2012 it was 1.18%; in the first 4 months of 2013 it was 0.7% (note: the Fed itself states that the increase was 2.9%. After re-doing the calculations the above percentages came up). Thus, money creation is slowing down, which forces inflation to fall. The fact that the monetary base in increasing is basically pittance given the amount of money in the system, although if it was reduced then inflation would drop even further. Yet, are credit/money creation and unwilling banks the whole story or is there something more to QE?

Enter velocity of money. According to theory, money velocity depends on an additional 6 factors, of which the quantity of money, the propensity to consume and liquidity preferences (with the 2nd and 3rd factors being essentially the same) are the most volatile. As we have seen in the previous paragraph, QE does not affect the quantity of money unless new credit is created by the banks (and the slow increase is shown in the above graphs). As a consequence, all we are left with is the marginal propensity to consume, or basically how much of our income we choose to save or consume. It is a well-known fact that people spend more (and save less) in times of boom and spend less (thus saving more) in times of recession/depression. Thus, at times of depression it is only logical that, even if the money supply is constant, the velocity of money is reduced and thus the price level is reduced.

Enter velocity of money. According to theory, money velocity depends on an additional 6 factors, of which the quantity of money, the propensity to consume and liquidity preferences (with the 2nd and 3rd factors being essentially the same) are the most volatile. As we have seen in the previous paragraph, QE does not affect the quantity of money unless new credit is created by the banks (and the slow increase is shown in the above graphs). As a consequence, all we are left with is the marginal propensity to consume, or basically how much of our income we choose to save or consume. It is a well-known fact that people spend more (and save less) in times of boom and spend less (thus saving more) in times of recession/depression. Thus, at times of depression it is only logical that, even if the money supply is constant, the velocity of money is reduced and thus the price level is reduced.

The above appear to have nothing to do with QE, yet, as we also know, it is difficult (extremely difficult to be fair) to distinguish between the forces which affect inflation. Thus, we cannot really infer by how much prices are affected by the QE or by the business cycle (i.e. the recession) in general. Thus, even as QE is initiated, bank loans are growing by much less than bank deposits (until 2012). Nevertheless, deposits and loans are again not telling us the whole story: why is inflation falling now and not in 2012 when the loans/deposits ratio reached its lower value? In 2013, Fed data show that loans have been increasing by more than deposits once again.

The most obvious outcome of QE is an increase in bond and stock prices; which is what it should do, in order for stock and bond returns to lower and people start using their money for other investment plans. However, although there exists a ceiling over which bonds do not offer a good return to their owners, this does not exist in the stock market. Shares can, theoretically at least, increase forever (and the 1990's have shown such examples of rapid and strong growth).

|

| Source: The Wall Street Journal |

The most obvious outcome of QE is an increase in bond and stock prices; which is what it should do, in order for stock and bond returns to lower and people start using their money for other investment plans. However, although there exists a ceiling over which bonds do not offer a good return to their owners, this does not exist in the stock market. Shares can, theoretically at least, increase forever (and the 1990's have shown such examples of rapid and strong growth).

As a commentator stated "QE is to stocks as booze is for self-confidence". Since people believe that QE is good for the economy, their expectations concerning growth are raised. Continuing on the chain of causality, when the economy grows, it is only rational that stock prices will rise. Thus, in order to make profits from that increase in stock market prices people pour more funds in the market to buy them while they are "cheap". In addition, an increase in the stock market indices, is an added incentive to invest in it, since returns are high and risk is relatively low. Then, as more money is poured in the stock market, prices rise, while consumption lags. As consumers focus more on the future than the present, it is obvious that short-term consumption will be decreased, an outcome of both the shifting of preferences and the increased returns of the stock market. Then if preferences are shifted from the present to the future, an increase in the stock market makes more people want to invest (long-term possibly?). Thus, consumption (i.e. money velocity and aggregate demand) is decreased while savings and stock market investment is increased. (Note that because of the recession, most investors are more risk-averse than what they were during the boom phase. Thus, they have an added incentive to invest in already established "blue chip" listed companies than riskier start-ups or smaller firms)

Summing up the chain of causality:

1. Government announces QE because the economy is doing bad, hoping that the banks will use that extra money to create additional credit.

2. If banks are not constrained by either the risk/reward trade-off or by any regulatory requirements, they lend and more credit creation results in increased inflation.

3. If not, then banks lend much less than the government hoped for.

4. Since investors are unaware of whether #2 or #3 hold, they choose to invest in the stock market, given that in any of the two cases growth is more than what they were currently experiencing and thus stock prices are expected to rise.

5. Thus market prices rise because more agents enter the market.

6. With prices rising, consumers who have been saving a much larger amount of their income than they were doing before because their time preferences have changed (i.e. they lower current consumption for future consumption), wish to increase the amount they will be able to use in the future by investing in the market (either directly or indirectly).

7. In addition, banks may use that extra QE "cash" to invest (speculate?) themselves in the stock market.

8. Thus, either by reducing credit or by reducing the amount spent, both aggregate demand and money velocity are reduced.

9. This leads to a slowing of inflation or to deflation.

10. Nevertheless, this situation will not necessarily perpetuate. As people see stock prices rise, they start selling off at one point and they choose to either invest in other products (i.e. lend if they are banks) or consume more (if they are individuals).

In short, QE might be deflationary if banks can and choose not to lend and stock prices rise; yet, it can also be inflationary if they do so. The deflationary effects are not permanent though: over time, and with the effect of QE declining, funds will flow from to the stock market to the real economy, boosting both consumption and money velocity. Overall, QE is not a bad strategy. Nevertheless, it does not always work like policymakers expected.

UPDATE: It looks like Paul Krugman had suggested that the QE2 success was in promoting growth via increasing consumption by raising stock prices. This appears to agree with point #10, where the people start selling off to capitalize on their gains. Yet, if this increasing trend in stock prices persists, people, assisted by the uncertainty of the current era, will tend to defer consumption for the future, as long as they believe that they will be able to consume more then than now.

Summing up the chain of causality:

1. Government announces QE because the economy is doing bad, hoping that the banks will use that extra money to create additional credit.

2. If banks are not constrained by either the risk/reward trade-off or by any regulatory requirements, they lend and more credit creation results in increased inflation.

3. If not, then banks lend much less than the government hoped for.

4. Since investors are unaware of whether #2 or #3 hold, they choose to invest in the stock market, given that in any of the two cases growth is more than what they were currently experiencing and thus stock prices are expected to rise.

5. Thus market prices rise because more agents enter the market.

6. With prices rising, consumers who have been saving a much larger amount of their income than they were doing before because their time preferences have changed (i.e. they lower current consumption for future consumption), wish to increase the amount they will be able to use in the future by investing in the market (either directly or indirectly).

7. In addition, banks may use that extra QE "cash" to invest (speculate?) themselves in the stock market.

8. Thus, either by reducing credit or by reducing the amount spent, both aggregate demand and money velocity are reduced.

9. This leads to a slowing of inflation or to deflation.

10. Nevertheless, this situation will not necessarily perpetuate. As people see stock prices rise, they start selling off at one point and they choose to either invest in other products (i.e. lend if they are banks) or consume more (if they are individuals).

In short, QE might be deflationary if banks can and choose not to lend and stock prices rise; yet, it can also be inflationary if they do so. The deflationary effects are not permanent though: over time, and with the effect of QE declining, funds will flow from to the stock market to the real economy, boosting both consumption and money velocity. Overall, QE is not a bad strategy. Nevertheless, it does not always work like policymakers expected.

UPDATE: It looks like Paul Krugman had suggested that the QE2 success was in promoting growth via increasing consumption by raising stock prices. This appears to agree with point #10, where the people start selling off to capitalize on their gains. Yet, if this increasing trend in stock prices persists, people, assisted by the uncertainty of the current era, will tend to defer consumption for the future, as long as they believe that they will be able to consume more then than now.

No comments:

Post a Comment