The Cypriot Parliament was to convene today concerning the issue of the deposits levy, yet sources state that they have postponed the issue until tomorrow. I am not a Member of the Parliament (not a very pleasant occupation during these times) yet if I was I would be worrying about several complications the 6.75-9.9% tax would cause.

1. What happens to the money?

If the haircut goes through then the two big banks (Cyprus Popular and Bank of Cyprus) will have an additional €5.8 billion in share capital. From what I can assume, approximately €4-4.8bn will be put to the former and €1.8-1bn to the latter bank in order to raise their capital adequacy ratios (namely Core Tier 1 and Tier 1). This is to be considered as cash accounting-wise since banks will ship the funds obtained via the haircut to the Central Bank, which will then distribute them as per each bank's needs. Then as shareholder equity will be increased to account for the increase in share number, cash amount will also be increased by those amounts. What will the banks do with that money then? If we assume that assets are down (due to the levy) then adequacy ratio will not be so hard to be reached and even exceed. Thus, the banks remain with three options:

- Use it to infuse liquidity in the market by way of lending

- Keep it as reserves

- Fund government debt

Option 1 would be the best for the overall economy, since it will boost businesses and assist in both consumption and investment. The only drawback is that the Cypriot people may just be too scared to invest or consume now. Option 2 will do nothing more than safeguard the banks in the case of the economy worsening (which it will do if Option 1 is not used). Option 3 will be very good for the state, yet the economy will not be able to enjoy this as the state cannot boost it through payments or investment (given the austerity measures and its agreement to abide by austerity and decrease it's budget deficit). Ideally, a combination of all 3 would be the best choice. Keep some money as reserves, boost the economy by providing liquidity in the form of loans and fund some government debt in order for the state to continue functioning smoothly.

2. Why does Cyprus need so much money (about €10bn) to sustain its government debt if it's deficit will be less than 3% in 2013 and Russia will roll-over the €2.5bn loan?

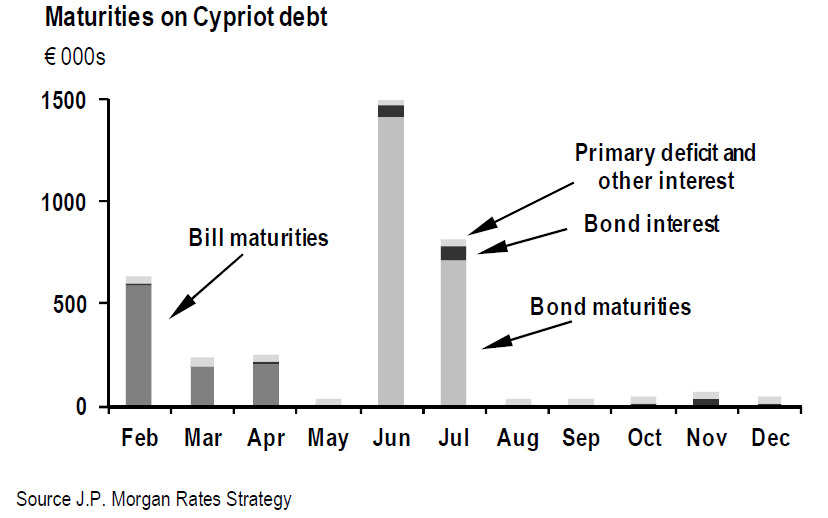

The question is pretty obvious: if the 2013 deficit is expected to be approximately 3% which is considered a yardstick for debt stability why does the island need €10bn? In 2013 the debt maturities are:

This means that all that is needed is to roll-over the debt, provided that no surprise expenses arise. Even if they do, then part of €5.8bn obtained from the deposits levy can be used to fund those. Then, the question once again becomes why does Cyprus need an additional €10bn?

3. What happens to loans attached to deposits?

Many banks do the following practice: they lend you €X while they freeze your €X cash amount in their accounts. Thus, they benefit from interest rate difference and you get a much lower rate. This kind of loan is considered to be 100% safe. Yet if you have a €110,000 loan guaranteed by a same amount term deposit then the levy would mean that your deposit is now worth €102250 (6.75 until €100,000 and approximately 10% after that). This is equal to a 7.05% decrease which the bank would now have assign an appropriate risk weight. I cannot know the numbers but how much will that additional risk weighting cost the Cypriot banks? (and this time were are talking about all the banks not just the two big ones)

4. Why sell out all bank branches in Greece?

Greek Finance Minister Giannis Stournaras has announced that Greek banks will almost surely take over the operations of the Cyprus banks subsidiaries in Greece. The problem with this situation is that Cypriot banks have assumed all the damage so far (i.e. 70% PSI, bad loan write-offs) which exacerbated their balance sheets. In addition, Greece is most likely out of the deep now and will start growing again in 2014-2015. Admittedly the worst is done. If we already know this, how can Cypriot banks grown over the next decade if they are being denied of all their opportunities? They have taken all the damage there was to take, and now just about when things are going to get better they are denied the opportunity to profit from their operations. Now that doesn't sound like a good scenario does it?

5. How can the outflow of money be stopped?

Nobody can doubt that many foreigners will intend to remove their money from Cyprus. Some will, other will not (the rationale for the latter being they have already taken what they wanted). Yet, can Cypriot banks cope with such an outflow? Wouldn't that severely damage their deposits' base? How will regulators and banks react if on Tuesday €10bn want to exit the system? Bank runs can be electronic nowadays too...

Given all the above, it makes being a Cypriot MP probably one of the worst jobs in the world. If they can answer all of the above and be certain that the benefits exceed the negatives then by all means go ahead with the haircut. But, wait a second; can you really be answer all of the above and be ready for their worse case scenarios?

Don't think so... The return to the Cyprus pound does sound more attractive now doesn't it? If one can bear the consequences that is...

Re 1: Perhaps you should rethink the idea of a balance sheet. Deposits are on the credit side. This bail-in simply means that some liabilities become equity, which improves the capital adequacy but changes nothing to the assets.

ReplyDeleteThink of it this way:

DeleteThe haircut will not mean only deposits from Bank of Cyprus will become Bank of Cyprus shares. Cash from other Cypriot banks will flow to the Bank of Cyprus and the Popular Bank which means that although in-bank transactions will not have an effect on cash, bank-to-bank operations will not. Those funds will be treated as "cash" in the receiving bank's accounts...

ReplyDeleteDo you need Personal Loan?

Business Cash Loan?

Unsecured Loan

Fast and Simple Loan?

Quick Application Process?

Approvals within 24-72 Hours?

No Hidden Fees Loan?

Funding in less than 1 Week?

Get unsecured working capital?

Contact Us At :oceancashcapital@gmail.com

Phone number :+16474864724 (Whatsapp Only)

LOAN SERVICES AVAILABLE INCLUDE:

================================

*Commercial Loans.

*Personal Loans.

*Business Loans.

*Investments Loans.

*Development Loans.

*Acquisition Loans .

*Construction loans.

*Credit Card Clearance Loan

*Debt Consolidation Loan

*Business Loans And many More:

LOAN APPLICATION FORM:

=================

Full Name:................

Loan Amount Needed:.

Purpose of loan:.......

Loan Duration:..

Gender:.............

Marital status:....

Location:..........

Home Address:..

City:............

Country:......

Phone:..........

Mobile / Cell:....

Occupation:......

Monthly Income:....

Contact Us At oceancashcapital@gmail.com

Phone number :+16474864724 (Whatsapp Only)

My name is Mrs Aisha Mohamed, am a Citizen Of Qatar.Have you been looking for a loan?Do you need an urgent personal loan or business loan?contact Dr James Eric Finance Home he help me with a loan of $42,000 some days ago after been scammed of $2,800 from a woman claiming to been a loan lender but i thank God today that i got my loan worth $42,000.Feel free to contact the company for a genuine financial service. Email:(financialserviceoffer876@gmail.com) call/whats-App Contact Number +918929509036

ReplyDelete