|

| The Markowitz Efficient Frontier |

What is the current state of the economics profession? From what we can witness any person who is not an economist would think that the state is bad (although there have been many within the profession which share this opinion, for example Paul Krugman not to mention many bloggers). Lately, I have had some time available to have a look at what appears to be the most influential theories of the 20th century (regarding stock markets that is): the Modern Portfolio Theory (MPT) and the Efficient Market Hypothesis (EMH). The former was introduced in the early 1950's by Harry Markowitz and the latter was introduced by Paul Samuelson and Eugene Fama in the early 1960's. Of the three people mentioned above two (Markowitz and Samuelson) received a Nobel price later on.*

I will waste no time in discussing whether the assumptions used by both theories are valid or not. This debate has been raging for nearly 40 years and I do not think that anything can be said to settle it. Besides, the limitations of the assumptions used were first presented by the persons who introduced it (for example one may have a look at Markowitz's or Samuelson's articles). Other than the assumptions and their implications as to the validity of the models, no article has ever stated what I think is the most important aspect of the debate:

If the MPT holds then EMH cannot hold and vice versa.

What do I mean by that? Having a a look at the EMH forms as presented by Fama we get the following:

1. Weak-form efficiency

Future prices cannot be predicted by analyzing past prices or past returns.

2. Semi-strong-form efficiency

In addition to the point (1), share prices adjust to publicly available new

information very quickly and in an unbiased fashion, such that no excess

returns can be earned by trading on that information.

3. Strong-form efficiency

In addition to point (2), share prices reflect all information, public and private, and no one can earn excess returns.

Given that the Strong-form efficiency is considered impossible in the real world we are only left with the first two alternatives. These two take for granted what Samuelson proved: properly anticipated prices fluctuate randomly, i.e. that future price movements are determined entirely by

information not contained in the price series. In simple words, prices must follow

a random walk.

The random-walk hypothesis is the pillar of the EMH. Without it nothing holds. If one could prove that prices do not fluctuate randomly then everything would collapse. Yet, as it has yet to be proven we may take for granted that prices do indeed follow a random walk. Even proponents of the EMH who have stated that markets may not always be perfectly efficient, such as Burton Malkiel, continue to believe that this holds.

Let us now have a look at the MPT as presented by Markowiz:

The underlying assumption is that higher expected returns also mean higher risk assumed by the investor. While many may argue that this does not hold, this sort of discussion is beyond the scope of this article. In any case, the MPT uses the expected returns of an asset, either by employing past returns or by using investors' "beliefs" for the future (which are rational and match the true distribution of returns) to form a portfolio of assets which maximizes expected return over a given risk amount.

Economists have been raging over the years if the models' assumptions are correct, what could happen if the assumptions are altered or whether the world functions this way. Now here I just assume that both models are correct.

Then ponder on the following:

If the EMH holds (even at its weakest form) then past prices are not a good forecast of future prices since future prices are to follow a random walk. In addition, any forecast of the future prices, given that they follow a random walk, would be erroneous as it would not be a good proxy for neither risk nor expected return. Thus, we would not be able to use MPT for investing purposes as it would not yield proper results.

Conversely, if MPT holds it would mean that either past prices can predict future returns or that investors beliefs are the real distributions of returns the random walk hypothesis does not hold.

Which of the two theories is correct? I would not know. Yet, what I would know is that if one of them holds, as described in its original form, then the other cannot. The worst part for their proponents is that the answer cannot lie in-between this as any deviation would mean that the random-walk hypothesis is discarded. If it holds and investors cannot forecast anything then why should they bother putting their money in the market? It appears that we can either forecast or not. It all boils down to whether stocks follow a random walk. If they do then the the EMH holds and the MPT is discarded. If they do not the opposite is true.

Simple enough isn't it?

*Update: Since the writing of this article, Eugene Fama has won the Nobel Prize in Economics for 2013. There has been a lot of talk about whether it was a good call or whether it was right to award Robert Shiller alongside with him. Dan Davies has an excellent article on why this was done, which reminded me of the conclusions in Paul Samuelson's paper which started the whole EMH literature (titled "Properly anticipated prices fluctuate randomly"):

“I have not here discussed where the basic probability distributions are supposed to come from. In whose minds are they ex ante? Is there any ex post validation of them? Are they supposed to belong to the market as a whole? And what does that mean? Are they supposed to belong to the “representative individual”, and who is he? Are they some defensible or necessitous compromise of divergent expectation patterns? Do price quotations somehow produce a Pareto-optimal configuration of ex ante subjective probabilities? This paper has not attempted to pronounce on these interesting questions.”

It appears that Paul Samuelson had a much greater understanding of what he was doing than most economists have about his work since.

Simple enough isn't it?

*Update: Since the writing of this article, Eugene Fama has won the Nobel Prize in Economics for 2013. There has been a lot of talk about whether it was a good call or whether it was right to award Robert Shiller alongside with him. Dan Davies has an excellent article on why this was done, which reminded me of the conclusions in Paul Samuelson's paper which started the whole EMH literature (titled "Properly anticipated prices fluctuate randomly"):

“I have not here discussed where the basic probability distributions are supposed to come from. In whose minds are they ex ante? Is there any ex post validation of them? Are they supposed to belong to the market as a whole? And what does that mean? Are they supposed to belong to the “representative individual”, and who is he? Are they some defensible or necessitous compromise of divergent expectation patterns? Do price quotations somehow produce a Pareto-optimal configuration of ex ante subjective probabilities? This paper has not attempted to pronounce on these interesting questions.”

It appears that Paul Samuelson had a much greater understanding of what he was doing than most economists have about his work since.

Isn't the EMH always viewed in as "risk adjusted returns" being unpredictable.

ReplyDeleteSamuelson's 1965 paper which was used by Fama in stating the EMH was titled "Proof that properly anticipated prices fluctuate randomly".

DeleteReturns are being calculated on the basis of prices and dividends. Thus, if prices cannot be forecasted how can you forecast returns?

How I Was Rescued By A God Fearing Lender {Lexieloancompany@yahoo.com}

DeleteHello, I am Andrew Thompson currently living in CT USA, God has bless me with two kids and a lovely Wife, I promise to share this Testimony because of God favor in my life, 2days ago I was in desperate need of money so I thought of having a loan then I ran into wrong hands who claimed to be loan lender not knowing he was a scam. he collected 1,500.00 USD from me and refuse to email me since then I was confuse, but God came to my rescue, one faithful day I went to church after the service I share idea with a friend and she introduce me to LEXIE LOAN COMPANY, she said she was given 98,000.00 USD by MR LEXIE , THE MANAGING DIRECTOR OF LEXIE LOAN COMPANY. So I collected his email Address , he told me the rules and regulation and I followed, then after processing of the Documents, he gave me my loan of 55,000.00 USD... So if you are interested in a loan you can as well contact him on this Email: lexieloancompany@yahoo.com or text +1(406) 946-0675 thanks, I am sure he will also help you.

Testimony on how i got my LOAN.....(Brianloancompany@yahoo.com)

DeleteHello Everyone, I'm Harvey Lee a resident/citizen of the United States of America.I am 52 years of age an entrepreneur/businessman. I once had difficulties in financing my project/business.If not for a good friend of mine who introduced me to Mr Chester Brian to get a loan worth $250,000 USD from his company. When i contacted them it took just 48 hours to get my loan approved and transfer to my account after meeting all their modalities i to their loan agreement/terms and conditions. Even if you have bad credit they still offer there service to you. They also offer all kinds of loan such as Business loan,Home loan,Personal loan,Car loan,Loan for Business start up and Business Expansion. i don't know how to thank them for what they have done for me but God will reward Mr Chester Brian mightily.If you need an urgent financial assistance you can contact them today via this email (Brianloancompany@yahoo.com) or text +1(803) 373-2162 and also contact there webpage via brianloancompany.bravesites.com

FINANCIAL RESTORATION: fundingloanplc@yahoo.com

DeleteHello am Nathan Davidson a businessman who was able to revive his dying business through the help of a Godsent lender known as Jason Raymond the CEO of FUNDING CIRCLE INC. Am resident at 1542 Main St, Buffalo, NY.. Well are you trying to start a business, settle your debt, expand your existing one, need money to purchase supplies. Have you been having problem trying to secure a Good Credit Facility, I want you to know that FUNDING CIRCLE INC. is the right place for you to resolve all your financial problem because am a living testimony and i can't just keep this to myself when others are looking for a way to be financially lifted.. I want you all to contact this Godsent lender using the details as stated in other to be a partaker of this great opportunity Email: fundingloanplc@yahoo.com OR Call/Text +14067326622

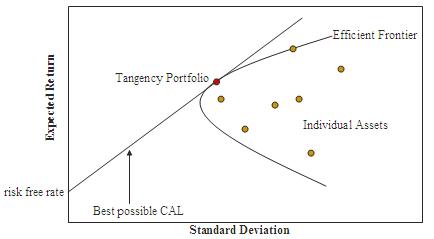

EMH requires that future prices cannot be predicted based on past prices. It says nothing about future returns and past returns, which is the relevant variable for MPT. In fact, MPT requires EMH in some sense because the same arguments that lead to EMH also lead to things like the efficient frontier and the tangency portfolio.

ReplyDeleteYes weak-form EMH does say that, but returns are being calculated based on prices and dividends. So if you need prices to calculate returns and prices are not forecastable then how can you forecast returns? Even if dividends can be forecasted (which I do not say they can) then you still have the other part of the equation as unforecastable.

DeleteThe only shared assumptions between the EMH and the MPT are:

1. Agents are aiming at maximizing utility

2. Agents are risk-neutral and rational

The above two are probably the most used assumptions in economic modelling.

Still, as I have said in the text the point here is not to argue the models' assumptions.

Is it not possible for something to follow a random walk, but at the same time for investors to have a rational view as to its expected volatility? So that's EMH and MMT both applying.

ReplyDeleteIt depends on what you mean "a rational view". The EMH postulates that nothing of the past can be used to forecast the future. If you use past prices (or whatever) to estimate something of the future then you do not adhere to the EMH. EMH is basically stating that there can be no forecast based on past data thus any view based on that will be erroneous.

DeleteHow I Was Rescued By A God Fearing Lender {Lexieloancompany@yahoo.com}

DeleteHello, I am Andrew Thompson currently living in CT USA, God has bless me with two kids and a lovely Wife, I promise to share this Testimony because of God favor in my life, 2days ago I was in desperate need of money so I thought of having a loan then I ran into wrong hands who claimed to be loan lender not knowing he was a scam. he collected 1,500.00 USD from me and refuse to email me since then I was confuse, but God came to my rescue, one faithful day I went to church after the service I share idea with a friend and she introduce me to LEXIE LOAN COMPANY, she said she was given 98,000.00 USD by MR LEXIE , THE MANAGING DIRECTOR OF LEXIE LOAN COMPANY. So I collected his email Address , he told me the rules and regulation and I followed, then after processing of the Documents, he gave me my loan of 55,000.00 USD... So if you are interested in a loan you can as well contact him on this Email: lexieloancompany@yahoo.com or text +1(406) 946-0675 thanks, I am sure he will also help you.

Before one questions decades of empirical work done by some brilliant economists, a dose of humility is suggested.

ReplyDeleteIf you read Samuelson's paper, on page 2 he says, 'This martingale property of zero expected capital gain will then be replaced by the slightly more general case of a constant mean percentage gain per unit time'.

Additionally, I'd recommend reading the substantial amount of writing that Fama has done on the subject, among many others, since 1970. There is far more nuance to the EMH than typically presumed.

First of all, this is not an arrogant post. I am merely stating something that I feel people have not been discussing over the years. Second, the Samuelson paper is much distinct from the Fama one. Samuelson just said that "properly anticipated prices fluctuate randomly"; it was Fama who took it one step further and suggested that stock prices move randomly.

DeleteBy reading what Fama has written on the subject one should not forget to throw a look on Shiller, Lo and MacKinley and Grossman and Stiglitz. I cannot profess to have full knowledge of the subject (and as you have seen I have not commented on whether I believe the MPT or the EMH to be correct or not) but, as said before, this is merely something that many have been avoiding through the years.

The tone of your post isn't arrogant but the intellectual presumptuousness is. You are claiming that very smart people who have spent their lives studying this field have made an elementary error in basic assumptions.

DeleteAs far as critics of EMH, I have a lot of respect for many of them who make valid criticisms, which exist. No model of reality is perfect and any model is made better by allowing new data and analysis to inform and refine it.

But as far as reading critics, it makes no sense to do so until you understand the original argument. EMH, as stated by Fama, does most certainly not say that prices are a complete random walk. Per his paper on EMH, written in 1970, p. 387 footnote 5, 'The random walk model does not say, however, that past information is of no value in assessing distributions of returns. Indeed since return distributions are assumed to be stationary through time, past returns are the best source of such information. The random walk model does say, however that the sequence (or the order) of the past returns is of no consequence in assessing distributions of future returns.'

They do assume that returns are i.i.d., which is empirically false, but that is widely acknowledged today, and computing power now allows empiricists to bootstrap past distributions rather than assuming the simple two parameter normal model.

Additionally, most of the anomalies pointed out in the subsequent literature (including the Fama-French Size/Value factors) are included in any test of EMH. There are other anomalies (momentum, low beta, which was actually a Fischer Black finding, etc.), but each of those anomalies is risky. Indeed, the volatility of the anomalies is generally as high, or higher than that of the market premium.

But back to the point: EMH and MPT are not contradictory whatsoever, because EMH does not state past prices provide no valuable insight into future prices. As Fama points out, there is value in the data, and thus MPT is simply using that data, assuming that the distribution of returns of various assets is stable over time, and optimizing the mix of assets to achieve an 'efficient' portfolio.

Now there are plenty of arguments against that assumption, but it does not mean that MPT and EMH are in conflict. It just provides a long term model of the relationship between assets and returns, but one based only on past experience. Again, what we see is that deviations from the model often provide opportunities to make excess returns, but the riskiness of those excess returns can be quite high. The value premium underperformed for nearly a decade, the momentum anomaly is currently underperforming, etc. So none of these strategies is an arbitrage strategy that provide risk free excess returns.

So is EMH wrong? Most certainly yes. But do we have anything that does better than it? There aren't really any compelling empirical options. Sure, behavioralists tell some really good stories and have some good examples that we should keep in mind. However, they don't provide a coherent testable model. Indeed, I think behavioralists would do themselves a favor by acknowledging that they may have solid explanations for some of the anomalies that have been found, but not a full blown asset pricing model.

To be fair, I think EMH advocates can be just as frustrating in their defense. There is room for a constructive dialogue between both groups, but very few on each side are willing to admit that. I think that has led to this horribly incorrect view on what is meant by EMH and its implications. If there is one area where Fama has failed, it is in his articulation to a wider audience the basic implications. Perhaps that is for the next generation.

No I am not claiming that and I doubt that there is anything of intellectual pompousness from my side in this discussion. I am merely claiming that the two theories cannot coexist (in their original form as also stated in the article) unless they are modified. And this has not been addressed thus far that is why I am mentioning it.

DeleteCopy from your quote: "The random walk model does say, however that the sequence (or the order) of the past returns is of no consequence in assessing distributions of future returns."

I am not arguing against i.i.d here, I have not even mentioned that in the article. Yet, when you are saying that the sequence of past returns is of no consequence in assessing distributions of future returns what exactly do you mean if not that past prices are not a good predictor of future prices? If the past distribution is of no use for the future distribution then why should I use it in my estimations/forecast? The random walk model depends on the independence of the variables which, if applied to markets, is the same as saying that past values are not a good predictor of future ones; something which the MPT relies on when it estimates the beta. And isn't bootstrapping essentially creating random distributions from data?

I can agree with Fama (and you subsequently) on one thing: the reason why there has not been a total dismissal of the EMH is that no other theory can work in general, just in specific cases. Yet, this does not mean neither that the EMH holds and neither that no other theory will ever be found.

Your two final paragraphs are the ones which I agree more with: we need dialogue and yet we need to be open to new ideas and criticism. You are right that no other theory thus far has worked in general and not just specifics no matter what its supporters might claim. I agree with the EMH that markets usually know; but this does not mean that they are either efficient or random.

Well considering you missed the 'not' in my quote of Fama, that is the whole point of what I was saying. Fama does NOT dismiss past returns as a whole as being informative. I would HIGHLY recommend reading his 1970 paper on EMH as it walks through all of this and covers the actual hypothesis he proposes. Critics tend to create caricatures of the EMH which are quite easy to knock down. So generally they are arguing about completely different things because by efficient, Fama does not mean markets know all or are perfect, just that it is systematically very difficult to beat the market, plain and simple.

ReplyDeleteThere is no conflict between EMH and MPT. There are plenty of problems with both, but no conflict. To assume that countless practitioners have missed such a basic incongruence is presumptuous, regardless of whether you believe so or not.

Apologies as I didn't read carefully but you selectively picked my fama quote. The first half says yes past returns are valuable, but their order is not necessarily so.

DeleteI did selectively use the Fama quote but the part I used could stand on its own and be correct. Past returns could perhaps be valuable: yet, if their order is not I practically have zero use for them. To say that they are "of no consequence" means exactly that. (to be honest I thought you were referring to the original 1965 paper not the 1970 one.)

DeleteIt is not presumptuous, think of it this way: in physics Aristotelian notions were dominating thought up until new discoveries were made; and many a clever physicist would swear by them. It is not that I believe practitioners were not clever or they have no idea of what is going on. I just feel that some times what is harder to see is what is more obvious.

I'll address your first point below, but I'd have to argue that comparing your very dubious claim EMH and MPT aren't compatible to the transition from Aristotelian physics to Galileo and Newton is quite, ummm, immodest.

DeleteI would think one would want to have a much firmer grasp of both before claiming the start of a revolution.

and bootstrapping is taking the realized historical distribution and sampling randomly from that, rather than assuming normal (which Fama admits that he did because computers weren't capable of doing this back then, so he discounts his results accordingly).

ReplyDeletealso, there are techniques which allow non random sampling of a bootstrapped distribution, i.e., try to mimic previous market regimes when correlations increased and the sample wasn't i.i.d.

there is a lot of very interesting stuff going on in the empirical world right now that has updated this theory. i think Fama himself has been fairly willing to update his priors as time has gone on as well.

Sampling randomly essentially means it is creating something that does not exist in the data doesn't it? In essence, using past data using and not using past data. Past prices, in the MPT are not sampled randomly to get the beta; they are used as they are. That is my point.

DeleteSo back to your earlier point, Fama was explicitly referencing Random Walk, which is only a special case of EMH. The looser form just assumes 'Fair Game' dynamics.

DeleteBut that is besides the point. EMH simply says that current prices reflect all information and is appropriately pricing future joint distribution of returns. In other words, using all past data, it is very difficult to systematically earn excess returns (relative to the amount of risk taken).

To cover MPT and betas, I don't really know what you mean. EMH needs to be tested using an asset pricing model. This involves betas. Both EMH and MPT assumes the distribution of returns of different assets is stable over time, i.e., expected returns and correlations are the same over long periods of time. MPT simply maximizes expected returns for a given level of risk by using the past historical returns and optimizing the mix of assets, assuming that expected returns and correlations are stable.

MPT does NOT say that you can earn excess returns by analyzing past returns. By assuming that the past distribution of returns will be the same as the future (and MPT does not care about sequence, unless by sequence you are implying the cross section, aka, correlations, which both MPT and EMH care about), you can create an efficient (not the same meaning as in EMH, but that is traditional terminology) portfolio. But MPT only cares about the long term averages and correlations and not the actual sequence. So again, I don't see that you are making any point.

EMH and MPT are complementary, not contradictory.

First of all, the Aristotelian-Newtonian transition was just an analogy to indicate that very clever people may believe in something wrong for a very long time. Yet, I am not suggesting that the EMH is wrong; my view is that it's a bit unrealistic.

DeleteIn fair game dynamics you mean perfect information, etc right?

As already said in the article, the original form of the EMH, i.e. the Fama (1965) article, specifically mentions the the random walk, which is just putting the "properly anticipated prices fluctuate randomly" notion into stock market context. Prices reflect all information about the past, present and future, thus I cannot earn excess returns if I use them correct? Yet, I need to use them in order to find my optimal portfolio, with regards to risk and return as the MPT states. If this portfolio, according to the EMH will fluctuate randomly in the future, then I will have nothing but a very vague idea of the risk and returns of it. Not excess returns mind you! I wouldn't even have any idea of the risk-reward relationship thus I wouldn't be able to find my optimal portfolio.

One of the basic tenets of the MPT is the beta right which we can say is the relationship between the stock and the index. Yet, I base the beta estimations on previous data, since I have no other options right? This is just for my risk-return relationship and my optimal portfolio not excess returns or anything of the like. But if past prices are just random, then my estimates about risk and return will be just wrong. I would have the same probability of selecting a low risk-return portfolio by throwing darts on a board.

The EMH tests using betas found that there is a correlation between betas and future betas; this is part of what led people to rethink the EMH since it cannot be random and non-random at the same time. Once again, excess returns have nothing to do with my argument. It is the risk-return relationship which cannot be known if prices fluctuate randomly, thus ruling out the probability of finding my optimal portfolio.

So first, I just want to reclarify the debate: you claim that EMH is contradictory to MPT because EMH claims past prices are random. Since MPT uses past prices as inputs to create an 'efficient' (not in EMH sense) portfolio, MPT and EMH aren't compatible. Is that right?

DeleteSo onto your points by paragraph:

1) Of course EMH is technically wrong and certainly unrealistic. It is a model and all models are by definition false. They are meant to provide a useful framework to think about how things work.

2) Fair game means that information is accessible to all investors and in a sense, 'fair'. You cannot game the system by systematically knowing information before everyone else, like early earnings releases.

3) Let's clarify things here. EMH does not rely the Random Walk as its core tenet. I'm presuming the article you are referring to is "The Behavior of Stock Market Prices". Even within that (I confess to not having read all 73 pages but I have read a lot of his recent work, including his 1970 review and most of his book, Foundations of Finance), he admits that strict RW is not a realistic assumption.

But that is besides the point (right now at least). Even within a RW, you can allow for a drift term, i.e., a higher level of returns for stocks rather than bonds. He calls this the 'Intrinsic-value-random-walk' market. The random walk is the error term in the equation you use to test EMH. Any test of EMH is a joint test of both market efficiency and a pricing model.

Now let's be very careful about what we call 'excess returns'. In EMH literature, this is returns above and beyond the level of risk taken, so you need to adjust for volatility. For MPT, excess returns might sometimes mean anything earned above the risk free rate, unadjusted for risk. Also, EMH says that the best predictor of the future price distribution of a security is its past distribution. It does not say it is unpredictable, just that the price of the security in the present reflects that information (for example, you might pay a higher multiple for cashflows with a higher level of certainty and that security may exhibit less volatility since its payouts may be less subject to bad events). So EMH does not say the portfolio will fluctuate randomly.

So what is the point of MPT, in light of the insights of EMH? MPT attempts to build a model that explains the movement of asset prices. Let's say the model is successful in explaining 70% of the movement of prices (which is high!), that implies that the other 30% of movement is either random or unexplained. However, using that 70% that we can explain, we try to build a portfolio of uncorrelated assets that gives us a certain level of return. In doing so, we hope the randomness or the unexplained variance offset eachother and bring down the vol of the portfolio.

4) There are estimation errors in the parameters, including beta, and beta doesn't have to be the stock index, it can be whatever you choose to regress against returns (oversimplification but multi-factors and state variable regressions can be run as well). Ideally, if you are adding enough assets into a portfolio, your covariance matrix will end up having a significant impact on the optimal portfolio and there is error in those estimates as well.

DeleteEMH isn't telling you that you can't earn future returns by optimizing your portfolio using MPT; indeed, it says the opposite! There is large uncertainty in estimating future returns. Don't take large concentrated bets because there is a large degree of randomness involved in the outcome and it resembles a fair chance dynamic (zero risk premium, i.e., idiosyncratic risk). Instead, take systematic risk, which is, in theory, rewarded (i.e., equity risk). Investors willing to accept these systematic risks (volatility) should be able to generate premiums for doing so. The last couple sentences are the theory behind why these things happen, not justification for EMH or MPT.

5) So, just to reiterate, EMH does not say prices move randomly. It allows for a drift term, and that drift term is likely related to the level of risk of the security. It just says that predicting the movement around that drift term is very very difficult to do in a systematic fashion.

Hopefully I've done a better job at explaining my position

Yes, that was my argument in the post.

Delete1. There are models which depict reality better than others; EMH is not in that category.

2. We agree on definitions then, although the strong-form EMH basically states that even inside information does not matter.

3.Yes that is the paper I was referring to and it is indeed long and tiring.

Using drift does not really prove a point. All it does is allowing for the model to start at a higher value, e.g. like you said, higher returns for stocks than for bonds although this does not always hold. It just says e.g. the stock market will fluctuate randomly above 2,000 points.

When I mentioned excess returns I meant the EMH definition (as you define it). Yet, even if you test the EMH definition, you are in fact somehow misusing it. You wouldn't be able to control for the risk if you had nowhere to depend on, given that prices move randomly.

Does it not really say that the portfolio will fluctuate randomly? Think of it this way: if the stock price reflects all past information (and future and inside information if we use the strong form) then all that is left which can alter my valuation is future information. Yet, this information is random by definition (not just in stock market, but in general). Thus, the future value of the portfolio will depend on future information which you do not have at the moment of estimating; then future prices will move randomly if information is random. This makes my estimation rather useless.

I agree with your points on the MPT, though. Yet, the MPT was not build on the EMH and that is for sure. Fist of all, Markowitz published his paper in 1952, 13 years before Fama and Samuelson; no matter how clever, Markowitz could not build something on a notion that had not been developed in his time.

4. I agree on the beta dynamics, but I disagree on the perception of the EMH. If it does say that then the EMH is contradicting itself. And large, concentrated bets are something against which the MPT advices.

5. A drift term does not mean that the model is not random. Have a look at this: http://people.duke.edu/~rnau/411rand.htm

Let's make the argument simpler: do you agree that the EMH comments that prices reflect all information available? (I would even let the strong form out and forget about inside information). If yes, then do you also agree that only future information can move prices?

I'm not going to sit here and try to continually knock down the straw man you have created. Go read ch. 5 of fama's foundations of finance, titled efficient capital markets, found for free on his website.

ReplyDeleteprices do not move randomly. whenever you test market efficiency, it is a joint test of both an asset pricing model and market efficiency.

saying the stock price reflects all available information does not mean that we cannot use past data to understand how future prices may move. it just means that the market, based on past data, is accurately pricing the stock. the past distribution of returns is likely to resemble the future distribution of returns.

your final point: yes that is true. EMH says that prices reflect all information. but that DOES NOT mean that the future price distribution of securities is unknown and inestimable. It explicitly states that the past distribution is the best estimate for the future distribution. "the appropriate current prices are determined by some model of market equilibrium - that is, by a model that determines what equilibrium current prices should be on the basis of characteristics of the joint distribution of prices at t."

i will not respond to any follow ups that clearly ignore what is publicly available information. it is your responsibility to actually read what is claimed by EMH if you believe you are going to refute it and its congruence with MPT.

Just a simple note: if you agree on my last point then you have created an ideological wall around your beliefs. If prices can only move by future information and future information is random then by construction, prices are going to be random as well. Unknown is one thing and random is another. Random does not meet unknown, yet it does mean unforcastable (up to a point). Nothing further to add.

DeleteAnd your quote clearly states "current prices" not future ones...

Interestingly, from what I have read on the subject, the only clear conclusion is that whenever the theory is proven non-functioning people just tend to say "yes, but we can change it and it might work ergo it works"

Great insights on EMT. It made my day and will rally help in solving my Corporate finance Assignment

ReplyDeleteHow I Was Rescued By A God Fearing Lender {Lexieloancompany@yahoo.com}

ReplyDeleteHello, I am Andrew Thompson currently living in CT USA, God has bless me with two kids and a lovely Wife, I promise to share this Testimony because of God favor in my life, 2days ago I was in desperate need of money so I thought of having a loan then I ran into wrong hands who claimed to be loan lender not knowing he was a scam. he collected 1,500.00 USD from me and refuse to email me since then I was confuse, but God came to my rescue, one faithful day I went to church after the service I share idea with a friend and she introduce me to LEXIE LOAN COMPANY, she said she was given 98,000.00 USD by MR LEXIE , THE MANAGING DIRECTOR OF LEXIE LOAN COMPANY. So I collected his email Address , he told me the rules and regulation and I followed, then after processing of the Documents, he gave me my loan of 55,000.00 USD... So if you are interested in a loan you can as well contact him on this Email: lexieloancompany@yahoo.com or text +1(406) 946-0675 thanks, I am sure he will also help you.

Thanks for give me information on this topic. you have sharing very nice post.

ReplyDeletehttps://www.roknelbeet.com/نقل-اثاث-بجدة/

https://www.roknelbeet.com/نقل-اثاث-بالدمام/

https://www.roknelbeet.com/نقل-اثاث-بمكة/

https://www.roknelbeet.com/تخزين-اثاث-بالرياض/

We write high-quality sample essays, term papers, research papers, thesis papers, dissertations, book reviews,nbook reports, speeches, assignments, business papers, Human Resource Management Papers, Accounting Papers, Essay Writing and custom web content

ReplyDeleteWe do custom work 100% original and plagiarism free .If you need help in any assignment just send us requirements with time limit ,we will quote a price and after your confirmation ,we start working on your assignment .An original work ready for submission provided to you . Email us your requirements.

Order us at: https://homeworklance.com/online-homework-help-homework-answers/

Email us at: ( info.homeworklance@gmail.com )

Advantages of Using Our Service:

A chance to make your studies easier.

Get all your requirements met on time.

Experienced writers from all over the world, proficient in many disciplines.

24/7 support from our team, both the writers and supporters are here for you.

Plagiarism free writing

Advanced Writing

Affordable Pricing

On-time Delivery

Admin

https://homeworklance.com/

This is a good post. This post gives truly quality information. I’m definitely going to look into it. Really very useful tips are provided here. Thank you so much. Keep up the good works viscosupplements

ReplyDeleteHello,

ReplyDeleteWe are a professional Cyber Tech credit team with a large ring around

the globe infected with more than 3 million debit malware and

skimmers, we get a blank ATM card and load them with a lot of money

quickly and safely, with which one can withdraw Cash either in euros or

Swiss franc from ATMs and can be used by any POS system

Note: Our cards are Illegal but trust me its 100% safe

Contact: Daneil Jerry LEE

Email: lee.jerry5555@gmail.com

WhatsApp +3197005033695

instagram takipçi satın al

ReplyDeleteaşk kitapları

tiktok takipçi satın al

instagram beğeni satın al

youtube abone satın al

twitter takipçi satın al

tiktok beğeni satın al

tiktok izlenme satın al

twitter takipçi satın al

tiktok takipçi satın al

youtube abone satın al

tiktok beğeni satın al

instagram beğeni satın al

trend topic satın al

trend topic satın al

youtube abone satın al

instagram takipçi satın al

beğeni satın al

tiktok izlenme satın al

sms onay

youtube izlenme satın al

tiktok beğeni satın al

sms onay

sms onay

perde modelleri

instagram takipçi satın al

takipçi satın al

tiktok jeton hilesi

instagram takipçi satın al

pubg uc satın al

sultanbet

marsbahis

betboo

betboo

betboo

smm panel

ReplyDeletesmm panel

Https://isilanlariblog.com

instagram takipçi satın al

hirdavatciburada.com

WWW.BEYAZESYATEKNİKSERVİSİ.COM.TR

servis

JETON HİLESİ

Good content. You write beautiful things.

ReplyDeletemrbahis

hacklink

hacklink

taksi

mrbahis

vbet

sportsbet

sportsbet

vbet

kadıköy

ReplyDeleteserdivan

çatalca

tunceli

fethiye

0YO

salt likit

ReplyDeletesalt likit

dr mood likit

big boss likit

dl likit

dark likit

EUP6K

salt likit

ReplyDeletesalt likit

HV3V

Eskişehir

ReplyDeleteDenizli

Malatya

Diyarbakır

Kocaeli

7RSAT

bitlis

ReplyDeleteurfa

mardin

tokat

çorum

T3M

maraş evden eve nakliyat

ReplyDeleteosmaniye evden eve nakliyat

adıyaman evden eve nakliyat

istanbul evden eve nakliyat

ordu evden eve nakliyat

PSO0E

01DAA

ReplyDeleteÇanakkale Evden Eve Nakliyat

Batman Evden Eve Nakliyat

Çerkezköy Evden Eve Nakliyat

Silivri Parke Ustası

Karaman Evden Eve Nakliyat

CC104

ReplyDeletefor sale dianabol methandienone

buy dianabol methandienone

Yalova Evden Eve Nakliyat

buy deca durabolin

Karaman Evden Eve Nakliyat

Hakkari Evden Eve Nakliyat

Urfa Evden Eve Nakliyat

order anapolon oxymetholone

steroid cycles for sale

37CF3

ReplyDeleteSivas Evden Eve Nakliyat

Balıkesir Lojistik

Gümüşhane Lojistik

Altındağ Parke Ustası

Karaman Şehirler Arası Nakliyat

Silivri Parke Ustası

Aksaray Şehirler Arası Nakliyat

Amasya Şehir İçi Nakliyat

Etlik Parke Ustası

DD659

ReplyDeleteYenimahalle Parke Ustası

Van Evden Eve Nakliyat

Kütahya Parça Eşya Taşıma

Hatay Şehir İçi Nakliyat

Mardin Evden Eve Nakliyat

Yozgat Şehir İçi Nakliyat

Çorlu Lojistik

Hamster Coin Hangi Borsada

Eskişehir Şehirler Arası Nakliyat

9928D

ReplyDeleteElazığ Şehir İçi Nakliyat

Çerkezköy Asma Tavan

Sincan Boya Ustası

Düzce Lojistik

Çerkezköy Evden Eve Nakliyat

Gümüşhane Lojistik

Etlik Boya Ustası

Silivri Fayans Ustası

Yalova Şehirler Arası Nakliyat

شركة عزل اسطح بالجبيل

ReplyDeleteشركة عزل اسطح بالقطيف

ED349

ReplyDeletebayburt canlı sohbet

düzce sesli görüntülü sohbet

kırıkkale canlı sohbet odaları

kırıkkale görüntülü sohbet sitesi

erzurum canlı sohbet bedava

denizli tamamen ücretsiz sohbet siteleri

canli goruntulu sohbet siteleri

yalova ucretsiz sohbet

sivas canlı sohbet uygulamaları

81C78

ReplyDeletekocaeli kadınlarla rastgele sohbet

bedava sohbet

muş goruntulu sohbet

uşak bedava görüntülü sohbet sitesi

erzincan sesli sohbet odası

ücretsiz sohbet uygulamaları

manisa ücretsiz görüntülü sohbet uygulamaları

tekirdağ ücretsiz sohbet uygulamaları

bingöl yabancı görüntülü sohbet

37D67

ReplyDeleteerzincan bedava görüntülü sohbet sitesi

van kızlarla canlı sohbet

Kastamonu Görüntülü Sohbet Ücretsiz

izmir mobil sohbet et

karabük sohbet siteleri

muğla en iyi görüntülü sohbet uygulamaları

Kars Rastgele Sohbet Siteleri

urfa sohbet

Bolu Canlı Sohbet Et

4AB4B

ReplyDeletekadınlarla sohbet

isparta ücretsiz sohbet uygulamaları

Tekirdağ Telefonda Rastgele Sohbet

diyarbakır kadınlarla sohbet et

Tekirdağ Rastgele Sohbet Odaları

sesli mobil sohbet

Adıyaman Seslı Sohbet Sıtelerı

Ankara Rastgele Canlı Sohbet

bitlis telefonda rastgele sohbet

37B71

ReplyDeleteHamster Coin Hangi Borsada

Dlive Takipçi Hilesi

Coin Para Kazanma

Instagram Beğeni Satın Al

Binance Referans Kodu

Binance Komisyon Ne Kadar

Bitcoin Madenciliği Siteleri

Tumblr Takipçi Satın Al

Tiktok İzlenme Satın Al

05965

ReplyDeleteKripto Para Nasıl Çıkarılır

Binance Referans Kodu

Görüntülü Sohbet Parasız

Spotify Dinlenme Hilesi

Threads İzlenme Hilesi

Binance Referans Kodu

Görüntülü Sohbet

Nonolive Takipçi Satın Al

Dlive Takipçi Hilesi

40C7E

ReplyDeletephantom wallet

debank

trezor suite

eigenlayer

pancakeswap

uwulend finance

dappradar

layerzero

dexview

hfghngfhtfyhfhntyj

ReplyDeleteشركة عزل اسطح بالقطيف

cgyhjnhujkm

ReplyDeleteشركة صيانة افران بالاحساء

شركة تسليك مجاري بالرياض JInO4rGhDz

ReplyDeleteشركة صيانة افران بعنيزة PdQiWJiWbJ

ReplyDeleteشركة مكافحة حشرات بالهفوف 5EGIk2nazG

ReplyDeleteتسليك مجاري بالاحساء kwStvSn5EU

ReplyDeleteشركة عزل مواسير المياه بالاحساء sC0YPVh0DO

ReplyDeleteشركة صيانة خزانات بعنيزة aqmpcKNvXx

ReplyDeleteشركة عزل اسطح بابها jdXvDQ9DSq

ReplyDelete8CED2CD63D

ReplyDeletetiktok türk takipçi

تنظيف افران الغاز بمكه qGgMzn8vNr

ReplyDeleteشركة تنظيف موكيت بالقطيف

ReplyDelete8R2DEpS5wY

شركة تنظيف مكيفات بالخفجي

ReplyDeletedyT5tWJOSl

FA2072408E

ReplyDeletemmorpg oyunlar

sms onay siteleri

mobil ödeme bozdurma

takipçi satın alma

-