It looks like some countries have started paying the price of austerity in people. I am of course talking about Spain where at least 10 people have committed suicide due to their lack of paying their loans and the subsequent bank and court decision for their eviction. Now, after 10 fellow humans have left this world, Mariano Rajoy's government has decided to put up a moratorium on evictions for the next 2 years. As this excellent article from Mike Shedlock states, the policy is expected to blow up spectacularly.

|

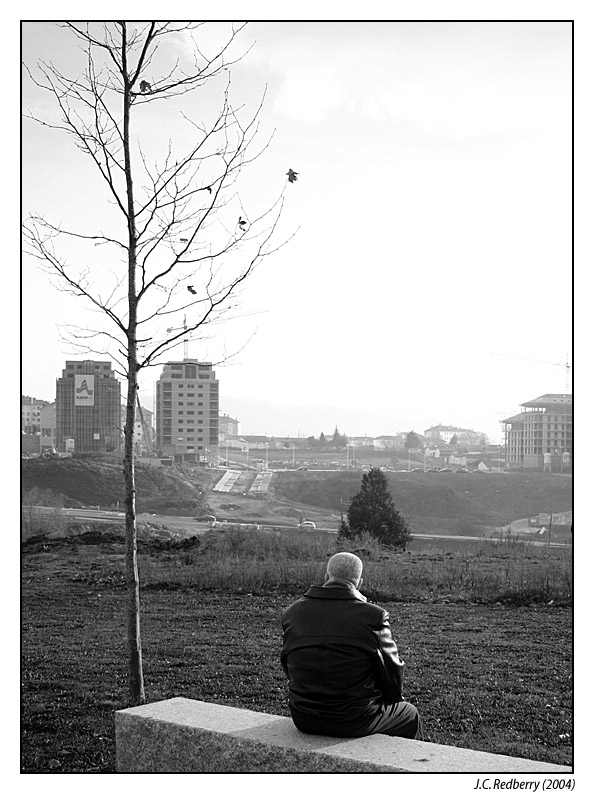

| An old man evicted in Santiago de Compostela, Spain. Source: Wikimedia Commons |

The reason is simple: suppose that you are paying your mortgage loan regularly and you have never missed a payment although you are financially struggling. Now if a law comes up which says that they cannot kick you out of your house even if you do not pay your mortgage, for the next 2 years, what is your motive to repay as you did? I would agree that most people would continue to pay their loans regularly because people have a high sense of values, and also know that when the 2 years end then they will face a much greater loan amount than before. Nevertheless, as Mike states, it is obvious that some people will take the option of not repaying, thus making the bank take a turn for the worse.

What has always amazed me in the world of politics and economics, is the lack of imagination from its practitioners. In the words of John Maynard Keynes they "are usually the slaves of some defunct economist". Yet, as most of them would hate to admit, they have neither the knowledge nor the imagination to produce solutions which would work in practice rather than in theory. Politicians lack understanding of basic economic truths. Economists lack understanding of world functioning. And unfortunately the combination provides us with solutions that are neither well applicable nor produce the right results. (You may ask the IMF for details on this. It has vast experience from the Greek experiment)

As usual, I wouldn't like to criticize without proposing something else. (you may imagine how I feel when I hear politicians argue about policies without actually proposing an alternative) What Spain should have done, is separate class of borrowers. What do I mean by that? For example the first class would be the persons who are unemployed for more than 6 months. The second class would be those who are unemployed for less than 6 months. The third would be those who are earning minimum wage, or due to other circumstances are facing troubles even though their earning power is larger (e.g. have many children, provide support to elders, etc), and the 4th class would be comprised by those who have "regular" jobs and can pay their mortgage.

To continue, it is more than obvious that the first and second class would need more support than the 3rd and 4th ones. However, the moratorium should not be aimed at people ceasing mortgage payments. First of all, a mortgage restructure, allowing for more installments with a lower amount, should take place. In simple words, if a mortgage has 20 years left and has a monthly installment of 400 euros, a restructuring would allow it to go for 30-40 years with an installment of approximately 200 euros. Now, this is more likely to work for the second group than the first. In that case, the moratorium could take place, although in a different notion: the bank would be allowed to sell the house/apartment, nevertheless, the tenant would be allowed to remain there for as long as it takes for the bank to find a seller. After the sale is completed, the bank will have to return an amount of money to the original tenant, who due to unemployment could not repay his/her mortgage. The amount, which would have an upper limit, will be directed at paying the rent on the tenants new house/apartment and will be deposited directly each month to the house/apartment owner's account. This would allow the unemployed to have a place to live, and it would prevent them for abusing the money if given in a lump sum. To avoid having to do this for everyone, it should be stated that this would occur only after a person has reached 6 or more months of unemployment.

Obviously, since this is just a proposal, groups of people may be more in practice, although I do believe that 4 classes would be a good number as well. This was not very hard to come up with. It is a policy which assists people in need and does not allow them to abuse the policy for their own purposes. Now, if I can come up with something like this, why don't they try to do it as well and not endanger neither banks nor people?

No comments:

Post a Comment