It seems like the media like uncertainty. They prefer it over times when credibility and logic define the world. The reason is obvious. In an uncertain world, the people want to receive as much information as they can get their hands on, and thus sales rise. However, for some inexplicable reason, the EU leaders appear to hold the view that uncertainty is good for them too.

An excellent example of the above is the latest disagreement between the ECB's president Mario Draghi and German Finance Minister Wolfgang Schaeuble, with the former stating that Cyprus could pose a systemically relevant danger to the Euro and the latter insisting that the country is not posing a danger to the Eurozone as a whole. In addition to this, Angela Merkel (a person who seems to prefer uncertainty and fragility over a strong economy) urged Cyprus to embrace

economic reforms and fully implement laws against money

laundering, but also said that Europe must show "solidarity" (whatever that may mean to her).

It seems as if we are watching the Greek situation all over again. The arguments move from "we will help" to "but [insert nation here] are doing this and that wrong", with Germany, (unfortunately for them and the Union) taking the position of the latter argument. Again, as stated on a previous article, the same question is posed: didn't the Germans, or whoever else holds that line of argument, know that there was money laundering in Cyprus in 2004 when they allowed it in the EU? How about in 2008 when it entered the Eurozone? Or a year ago? Was it something that just emerged over the past couple of weeks? Well, I would certainly hope not because the island had passed money laundering legislation much before its Eurozone entry and supposedly European legislators were overseeing them.

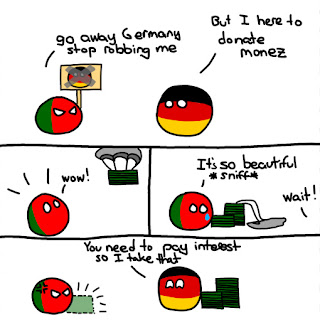

|

| Ireland, Portugal, Greece, Spain, Cyprus... Same old story isn't it? Thanks to Polandball-News for the comic |

Let us know remember what happened in the Cypriot economy: an economy with no recession since the 1970's, with GDP growth every year and a healthy banking system, crashed because of overexposure to the Greek market and the irrational Greek haircut (readers will also remember that I am still wondering why the Cypriot Finance Minister did not veto the Eurogroup decision concerning the 70% PSI haircut). We thus have a situation created by the mishandling of EU affairs and we just wash our hands off it.

Then there is talk about a systemic crisis, which is, in my humble opinion, irrelevant to the whole issue. What does it matter if the problem is systemic or not? What is the rationale behind this argument I fail to see. If someone is important then we assist him; if not then just let him collapse? This is Realpolitik even more than Henry Kissinger would have practiced. We are following the same erroneous ideologies which led to huge banks and companies which are too big to fail.

To be fair here, the island would have gotten into a bad situation sooner or later. It needs stronger banking regulations and better implementation; its housing bubble would have also burst sooner or later. Yet, this does not mean that we should kill a person just because he has a bad case of flu. Given time and regulations the island may have pulled this off. We will never find out. Instead, we went for the crazy solution and created a mess we couldn't get out of.

EU leaders are talking about whether they should give €9 or €10 billion to Cypriot banks, in addition to €6-7 billion for government expenses. They also seem to ponder whether the country's debt burden would be viable. I will spare them the thought and say it out loud as I have already said it before: it will not. The amount they are discussing is approximately 100% of GDP. Add to that an existing 80% debt-to-GDP ratio and you get an explosive situation. The brilliant solution for the brilliant €17 billion plan? A debt haircut which would affect Cypriot pension funds and banks. Who will again need more money. Money which will increase the debt burden and the need for a second haircut, with more money needed once again and so on... Simple as that. Yet, the problem could easily be solved with €3-4 billion (for details have a look at this).

The most important point to be made here is that the EU (or Germany, or any other sharing the same views) is not going to hurt the "Russian oligarchs" by denying assistance to Cyprus. Just like the case with Greece, Spain and Portugal, it is not the rich who are affected; it's the ordinary people, those who are working day and night to earn enough to support their families. Billionaires with 80-metre yachts and huge deposits in almost every country in the world will not care so much if they loses some money. Sure, it will be upsetting but people live equally well with €5 billion as they did with €6. Not to mention that they will readily transfer that money to some other destination(s) in the blink of an eye. Yet, the person who is labouring all day in constructions or sales to save €100 a month for a rainy day cannot do that.

If the EU leaders believe that denying money under cheap excuses like "money laundering" and "Russian oligarchs" is a good idea I have nothing more to add. I remind you though that these oligarchs and billionaires probably do not even live in Cyprus and most of them have deposits all around Europe as well.

What will be achieved is to set a precedent. And a very bad one too...

No comments:

Post a Comment